From zero to launch -

reducing tax filing time at scale.

Role

UX research, concept testing.

Creating a new Design System

Feature scoping and definition

Design & Prototyping

Usability Testing

Implementation Support: Collaborated with developers to align specs and refine solutions.

Team

8 Developers (3 Frontend, 5 Backend)

2 Project Managers

1 Solo Designer (myself)

Timeline

Spanning 11+ months

Tools

Figma & FigJam

Lookback.io

Slack

Zoom / Google Meet

Special Mentions

Sada - Product Manager, Financebox

Ruchita - Accountant, Financebox

Krishna - Front End Development, Financebox

About

Background & Project Initiation

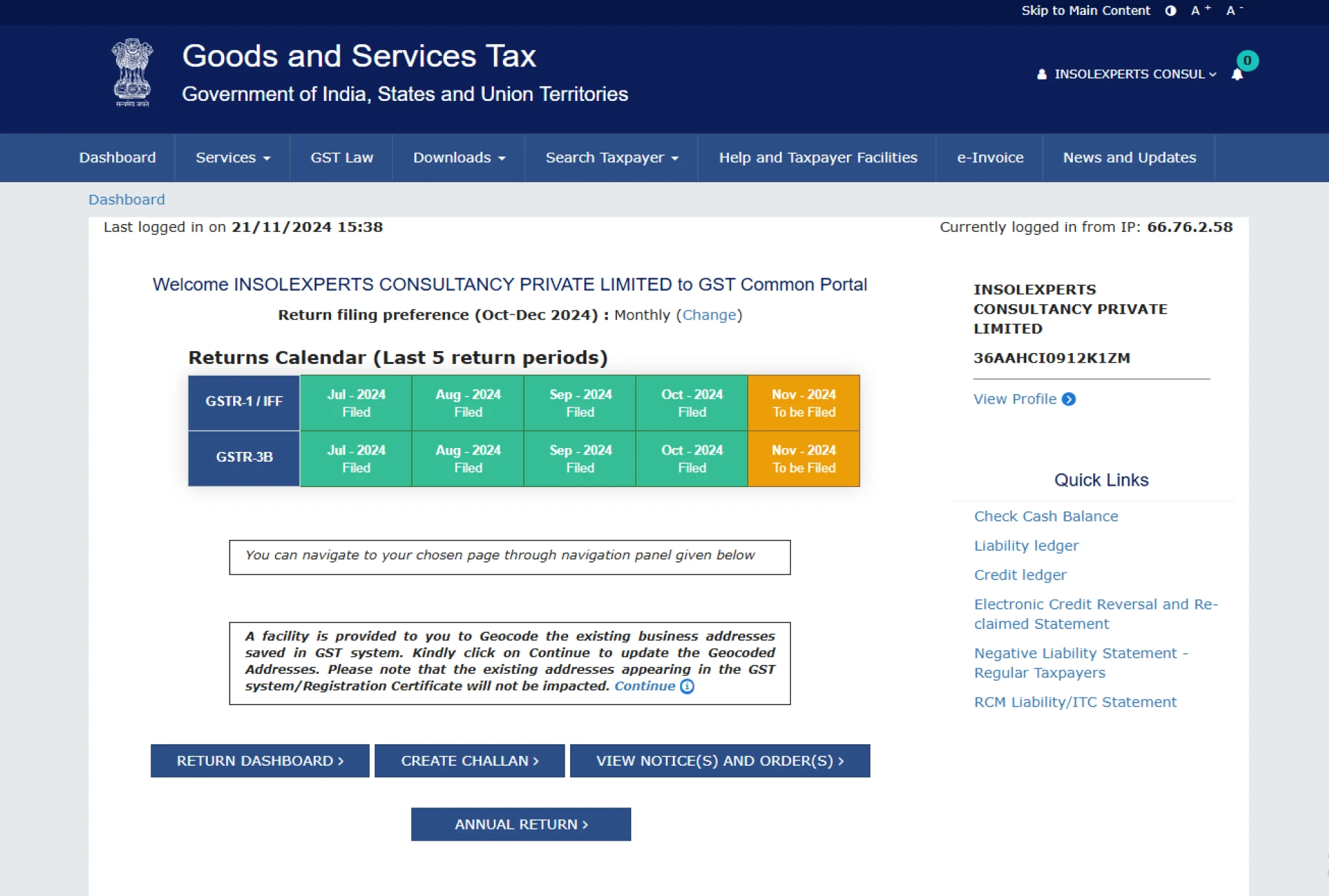

Tax accountants in India rely on ‘gst.gov.in’ to file taxes, but peak-time traffic often causes crashes, slowdowns, and missed deadlines, resulting in penalties and stress. Its complex interface further adds frustration, making tax filing slow and error-prone.

Financebox aimed to create a custom tax filing platform to eliminate errors, simplify workflows, and expand its client base across southern India. As the Lead UI/UX designer, I led the 0–1 creation of this portal to streamline filing processes for accountants and organizations alike.

Success Metrics

Solution and Impact

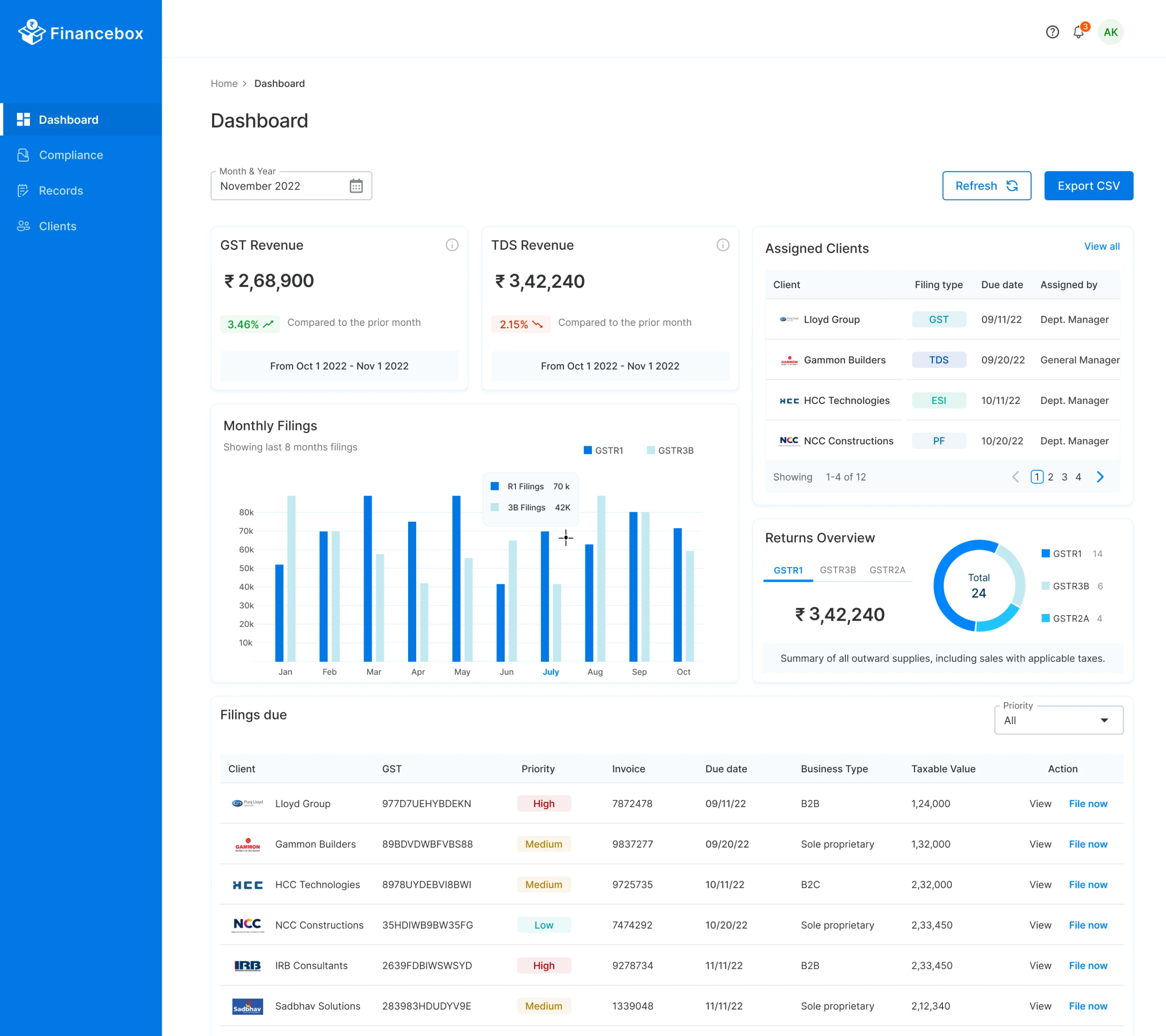

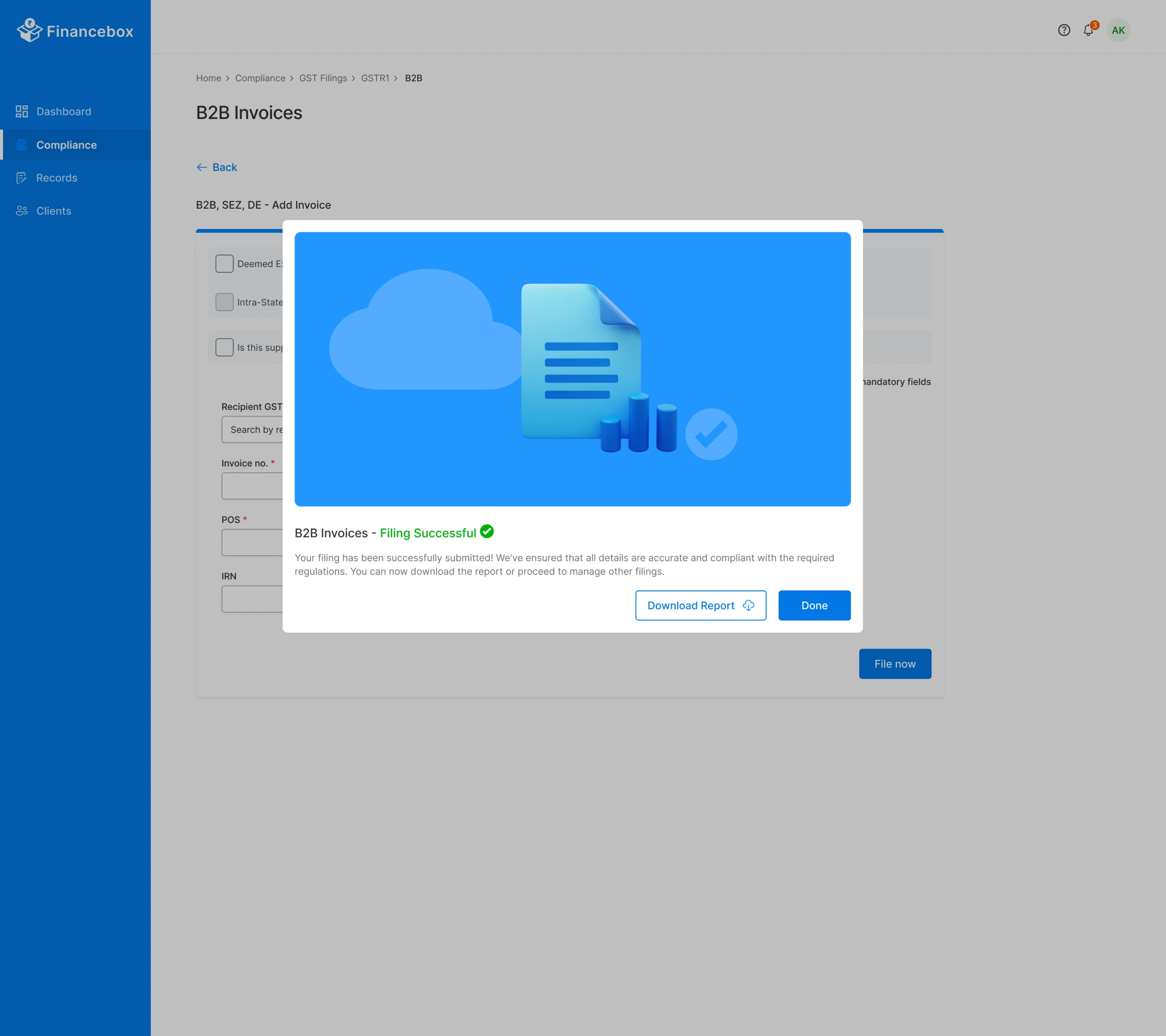

The solution featured a user-friendly interface with dashboards, quick actions, and a scalable, cloud-based design for seamless workflows and multi-client management, while achieving...

40%

Reduction in GST and TDS filing time

90%

Satisfaction rate among stakeholders during user testing

95%

Task completion rate across the platform

200+

New client onboardings post-launch

Discovery

Initial Research

The GST government portal (gst.gov.in) is a critical tool for tax compliance in India, but early research revealed frequent crashes, traffic surges, and complex workflows forcing accountants to file early or during off-peak hours. These challenges exposed the need for a simpler, faster, and scalable solution to streamline multi-client management and reduce errors.

Over 12 million users rely on gst.gov.in, causing traffic spikes near due dates. These surges often result in site slowdowns or crashes

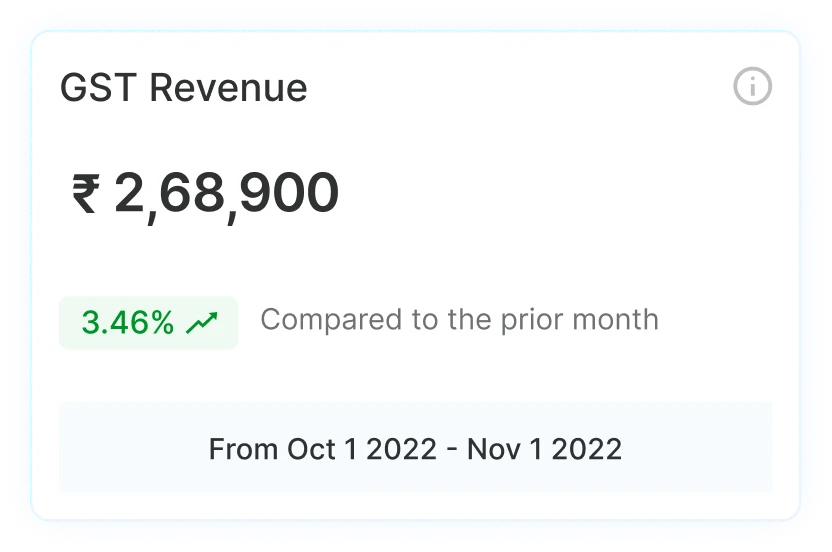

The existing GST portal dashboard offers only basic file statuses, leaving Accountants without the deeper insights they need to manage multiple clients effectively.

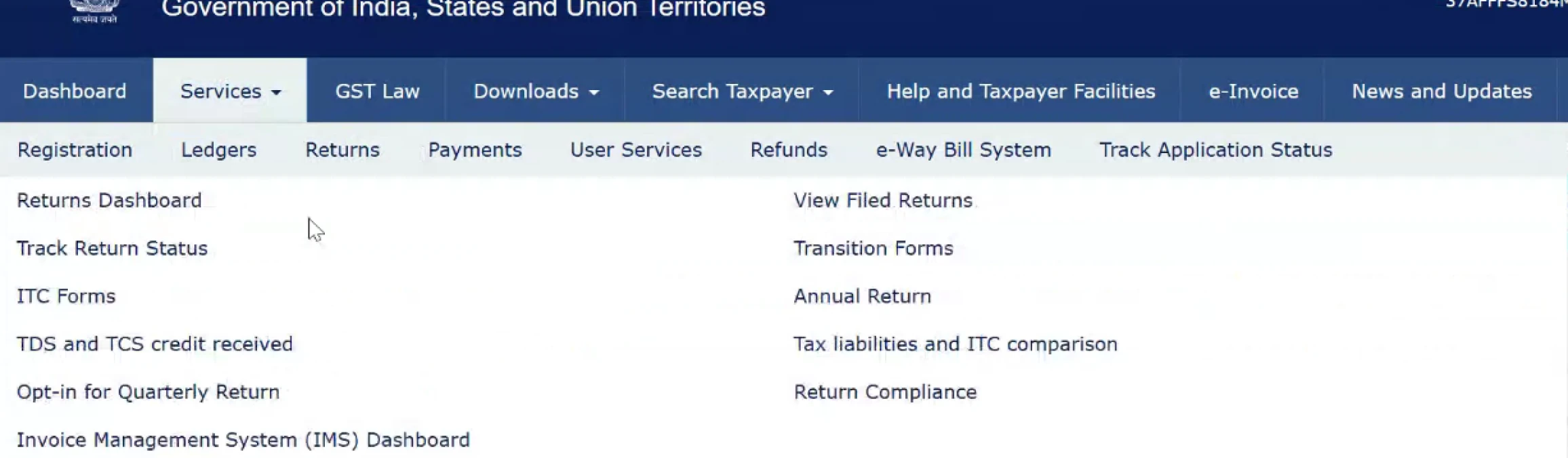

Though the GST portal offers 80+ pages, Accountants rely on just

“returns section” to file, forcing them onto a crash-prone platform.

Qualitative Research

Stakeholder Interviews

To lay the groundwork, for gaining qualitative data, I conducted in-depth stakeholder interviews with:

-Financebox leadership(2) - To clarify business goals, product scope, and success metrics.

-Chartered Accountants(6) - Who file on behalf of multiple clients, to understand their day-to-day pain points.

They said...

“I end up paying penalties because the GST site suddenly goes down.”

Ruchita, Accountant

“I mostly need just returns page. but navigating so many pages is confusing and time taking.”

Sada, Manager

“A single dashboard for all my client’s statuses would save me hours.”

Jahnavi, Accountant

“I manage multiple clients, but the portal doesn’t let me handle them in one go.”

Charan, Asst. Manager

Interviews exposed critical pain points:

Portal Downtime

Heavy reliance on the official GST site creates traffic spikes, forcing off-peak filing and added stress.

Deadlines & Penalties

Missed deadlines can lead to penalties and damaged client relationships.

Desire for Customizable Dashboards

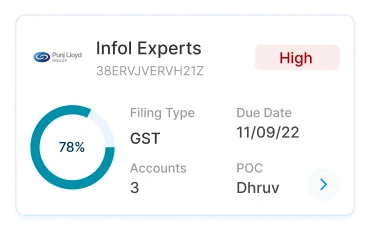

Accountants need quick overviews of due dates, client statuses, and pending filings.

Inadequate Navigation & Clutter

The existing GST portal is not user-friendly or intuitive, particularly during high-traffic periods.

Opportunities for possible solution:

Streamlined Filing Process

-One-click flows reduce confusion, errors, and time

-Beginner-friendly navigation focusing on core tasks only

Flexible Client Management

-Dynamic columns, bulk edits for multi-client handling

-Role-based access for efficient collaboration

Customizable Dashboard

-Single-view metrics: new clients, GST/TDS statuses, deadlines

-Modular widgets for quick customization and future expansions

Cloud-based Technical Framework

-Cloud-based, secure environment with API integrations

-MVP scope now, scalable for advanced features later

Strategy

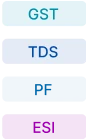

Card Sorting & Feature Categorization

To determine the most intuitive structure for our tax-filing portal, a card sorting exercise was conducted with users. By asking participants to group features and functionalities into categories, we gained clarity on what belongs together and how best to label each section.

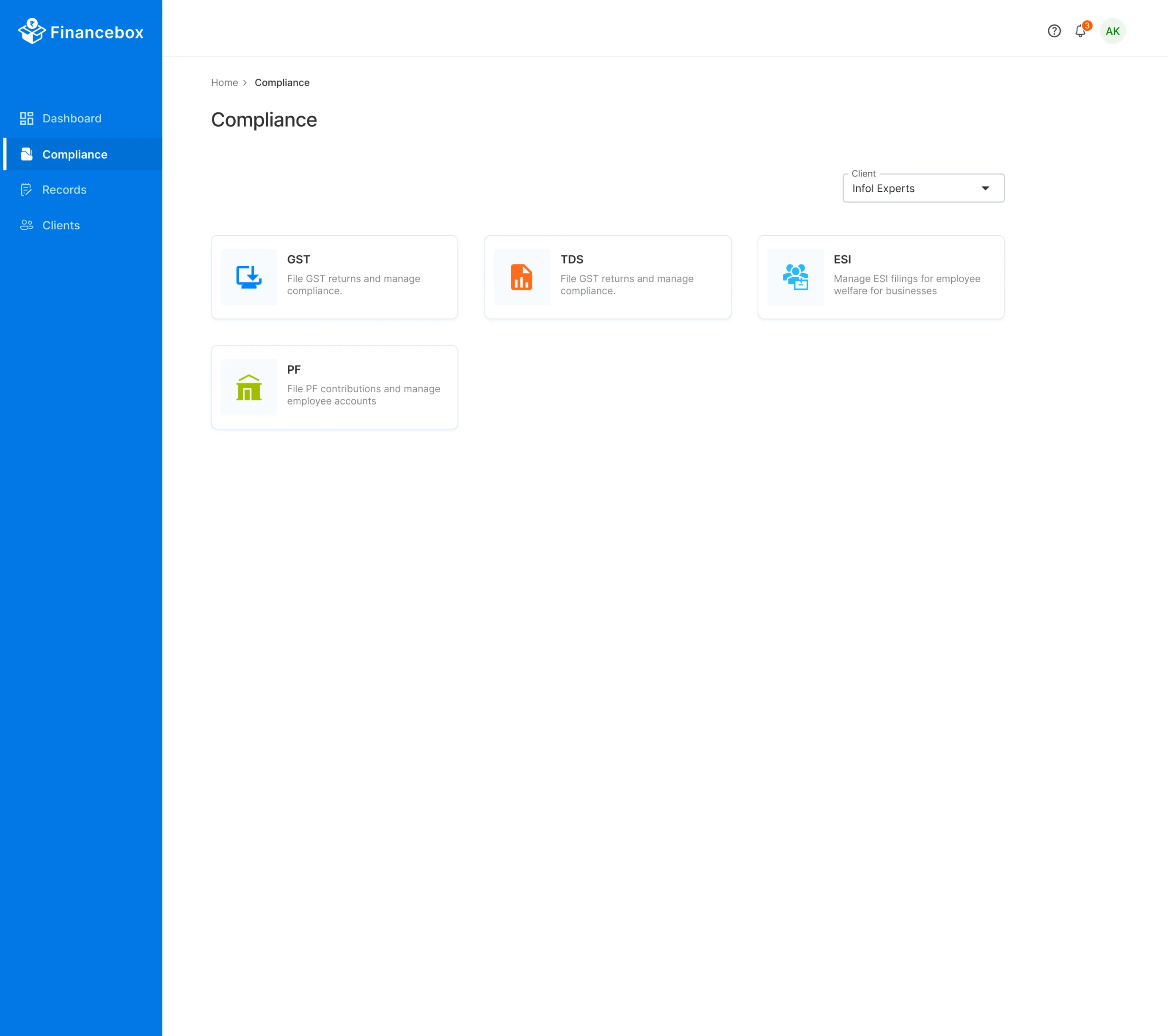

Compliance

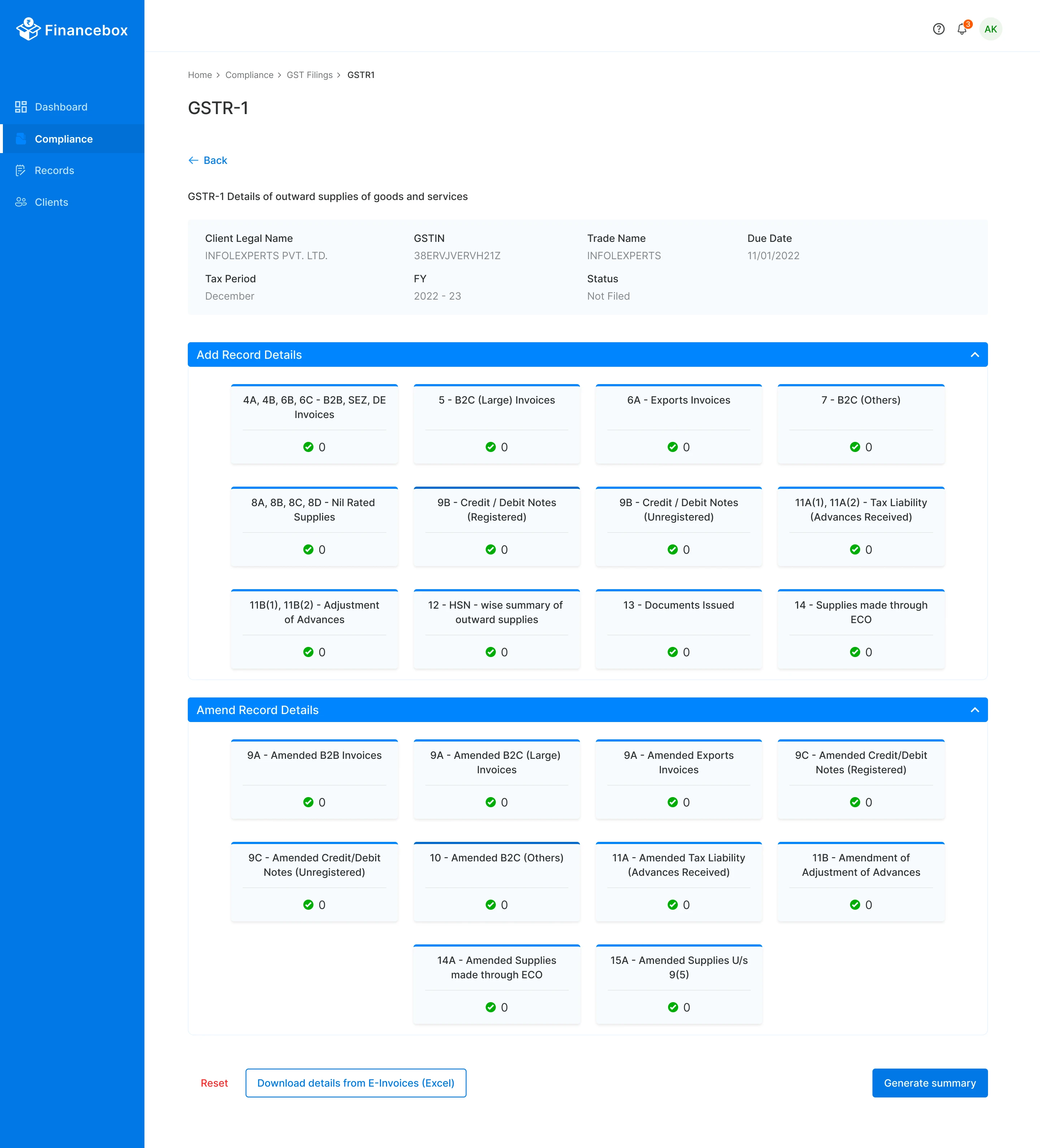

File GST

File TDS

File ESI

File PF

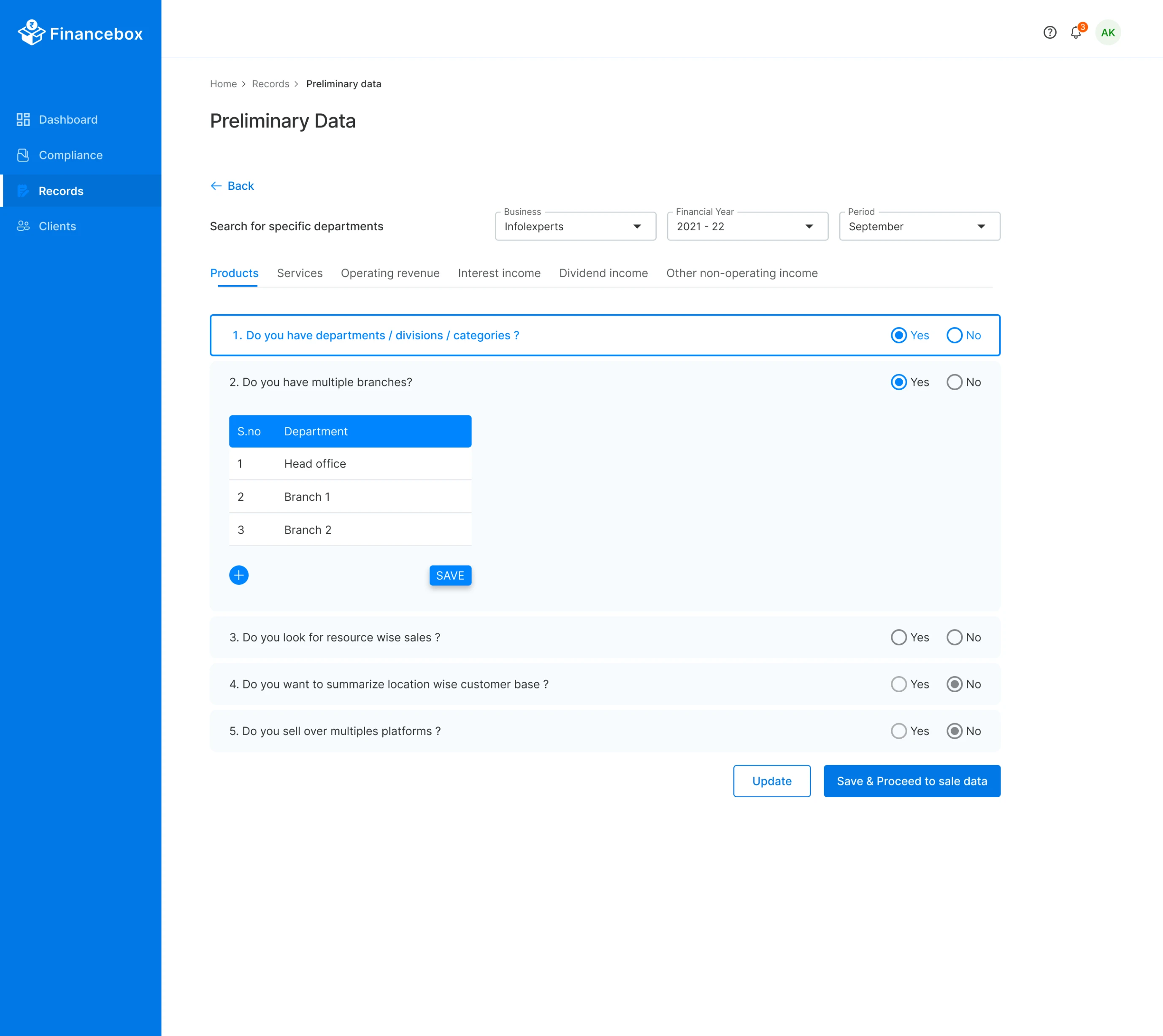

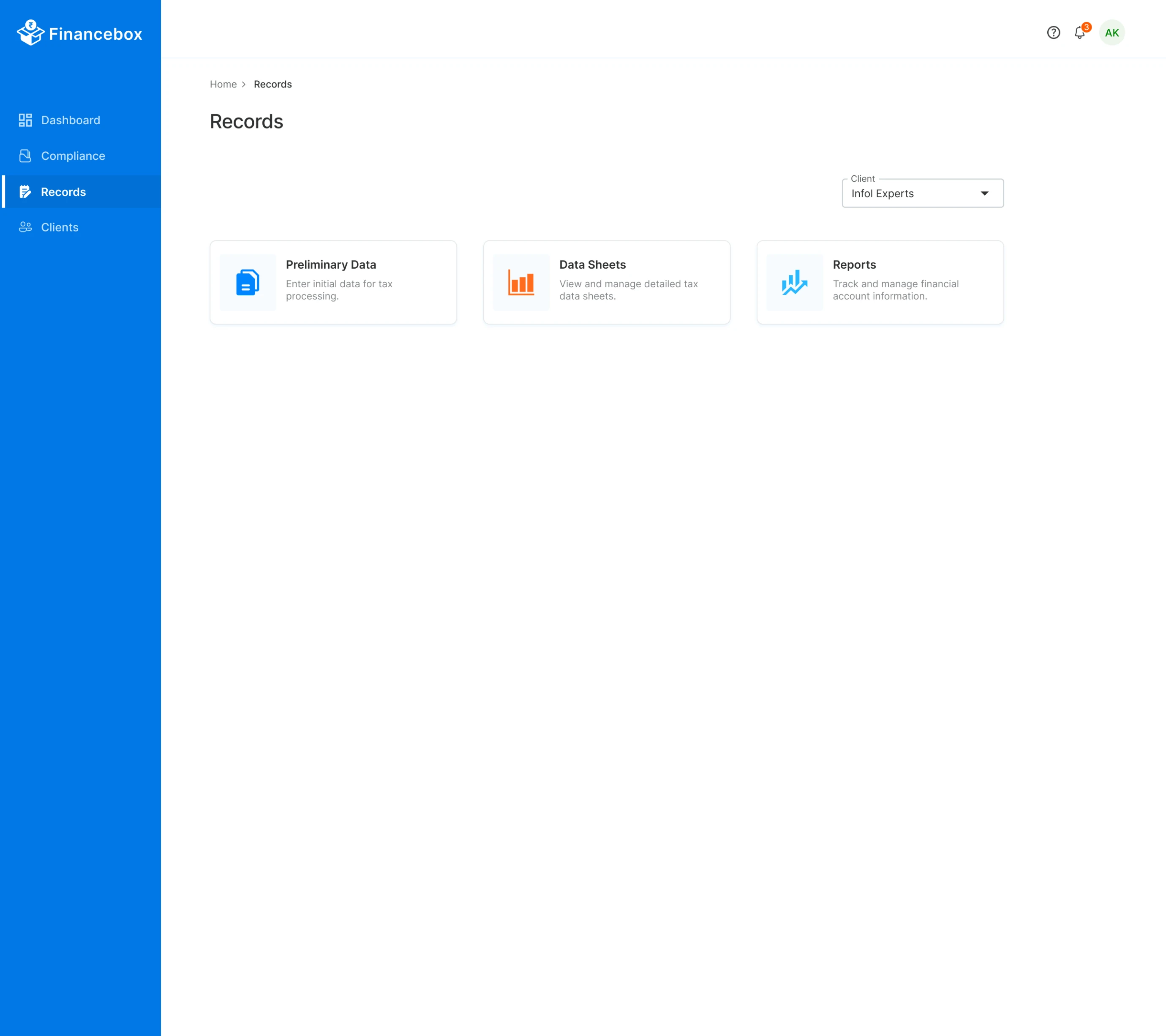

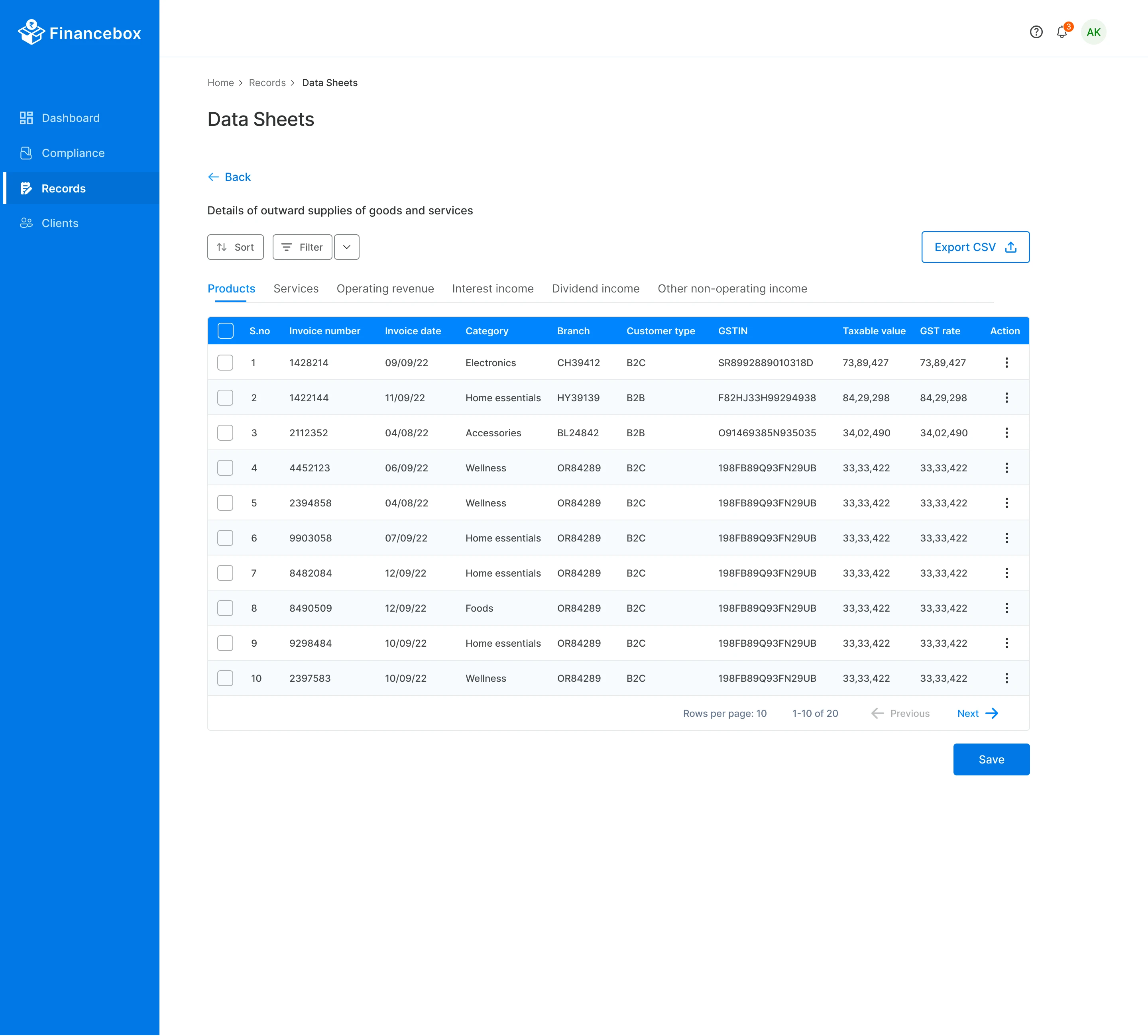

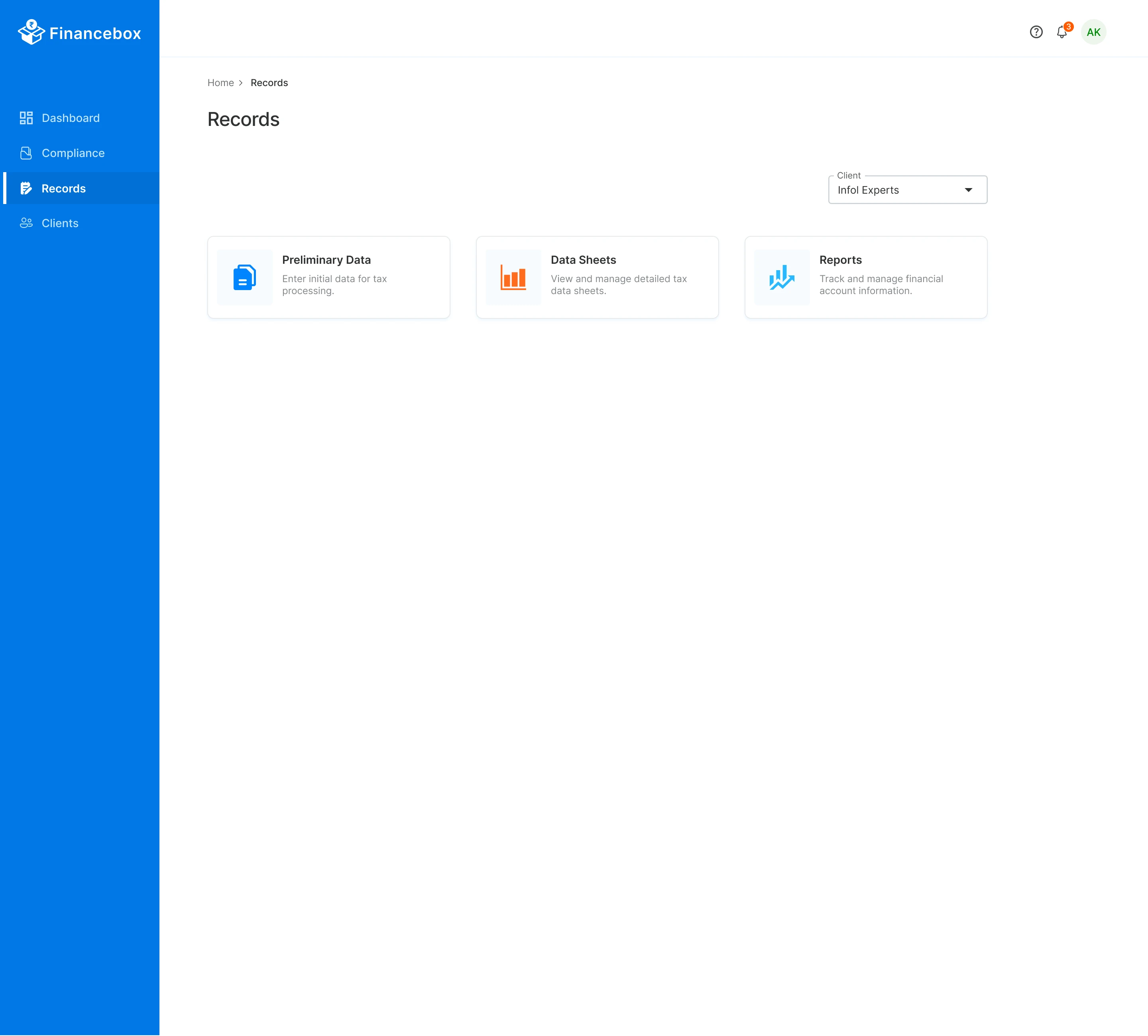

Records

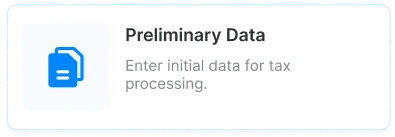

Preliminary Data

Data Sheets

Reports

Dashboard

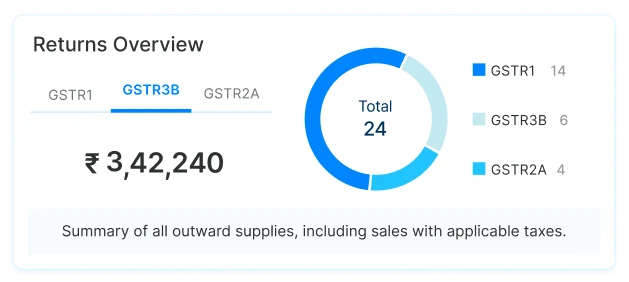

GST Status

TDS Status

Client Assignments

Upcoming Dues

Overall Summaries

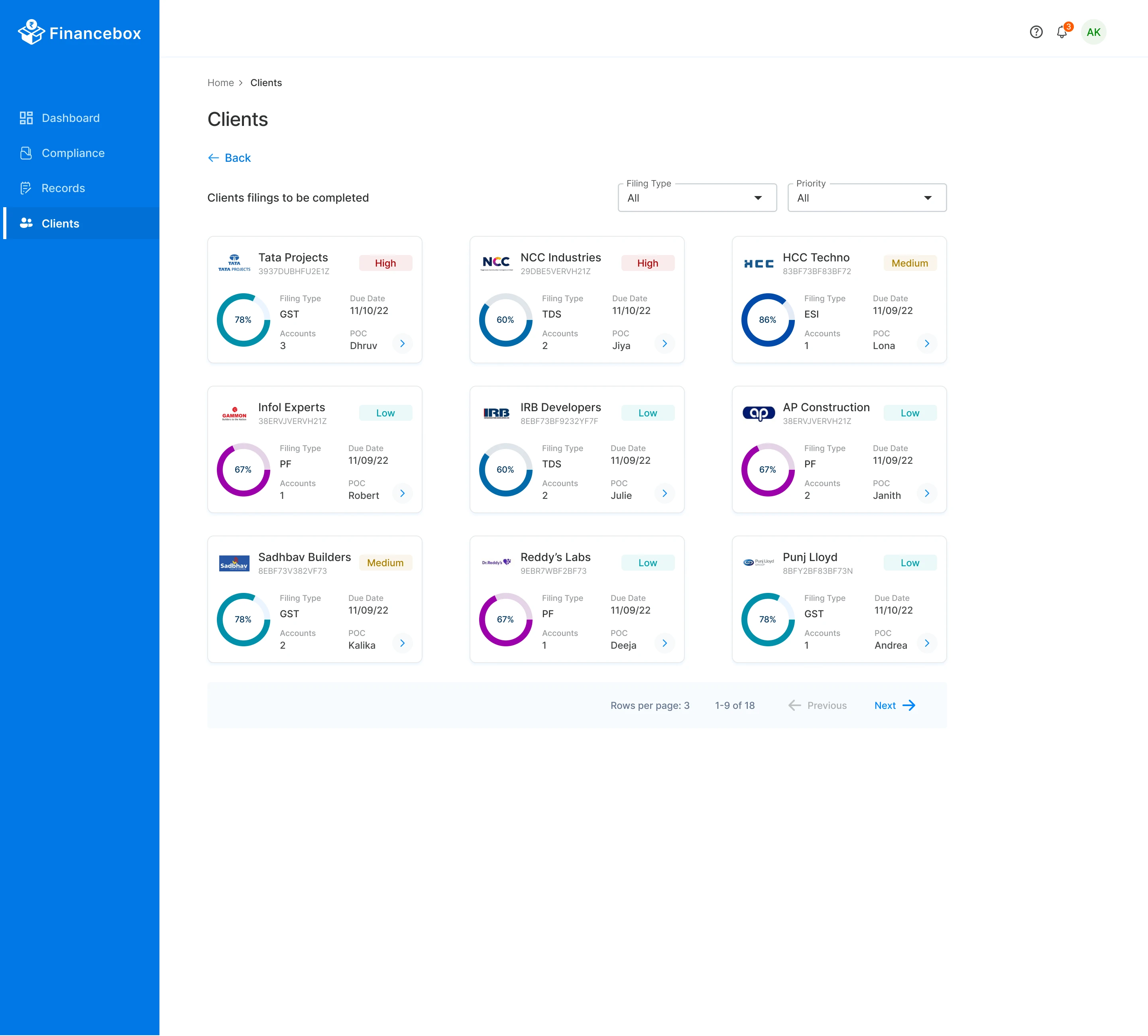

Clients

Clients List

Book Keeping

Preliminary data, data sheets, and crucial reports

GST/TDS filing statuses, new client assignments, upcoming due dates, and overall summaries.

Master list of clients, with options to view or add new details, manage tasks, and track progress.

Strategy

Defining Sitemap

To define the overall information architecture, how screens are grouped and how users access each section. I ensured all functionalities (GST filing, TDS filing, client management, record-keeping, etc.) have a logical place in the product hierarchy.

Strategy

User Flow: Guiding Users Seamlessly

In-depth user flows ensure that every step is logical and frustration-free, from logging in to filing taxes. By mapping each click, accountants know exactly how to navigate, preventing confusion and maximizing productivity.

Strategy

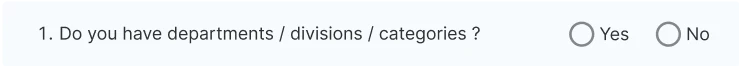

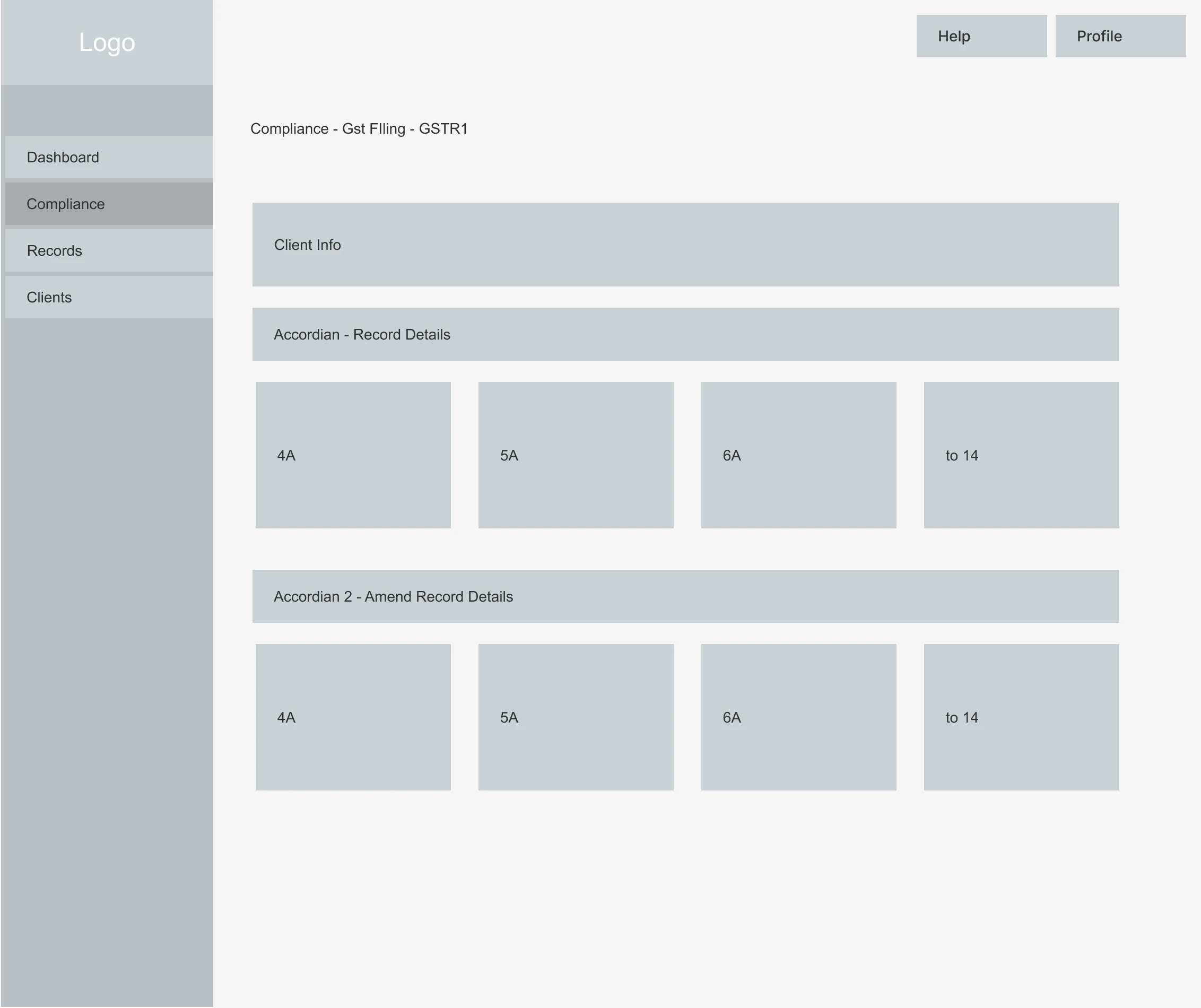

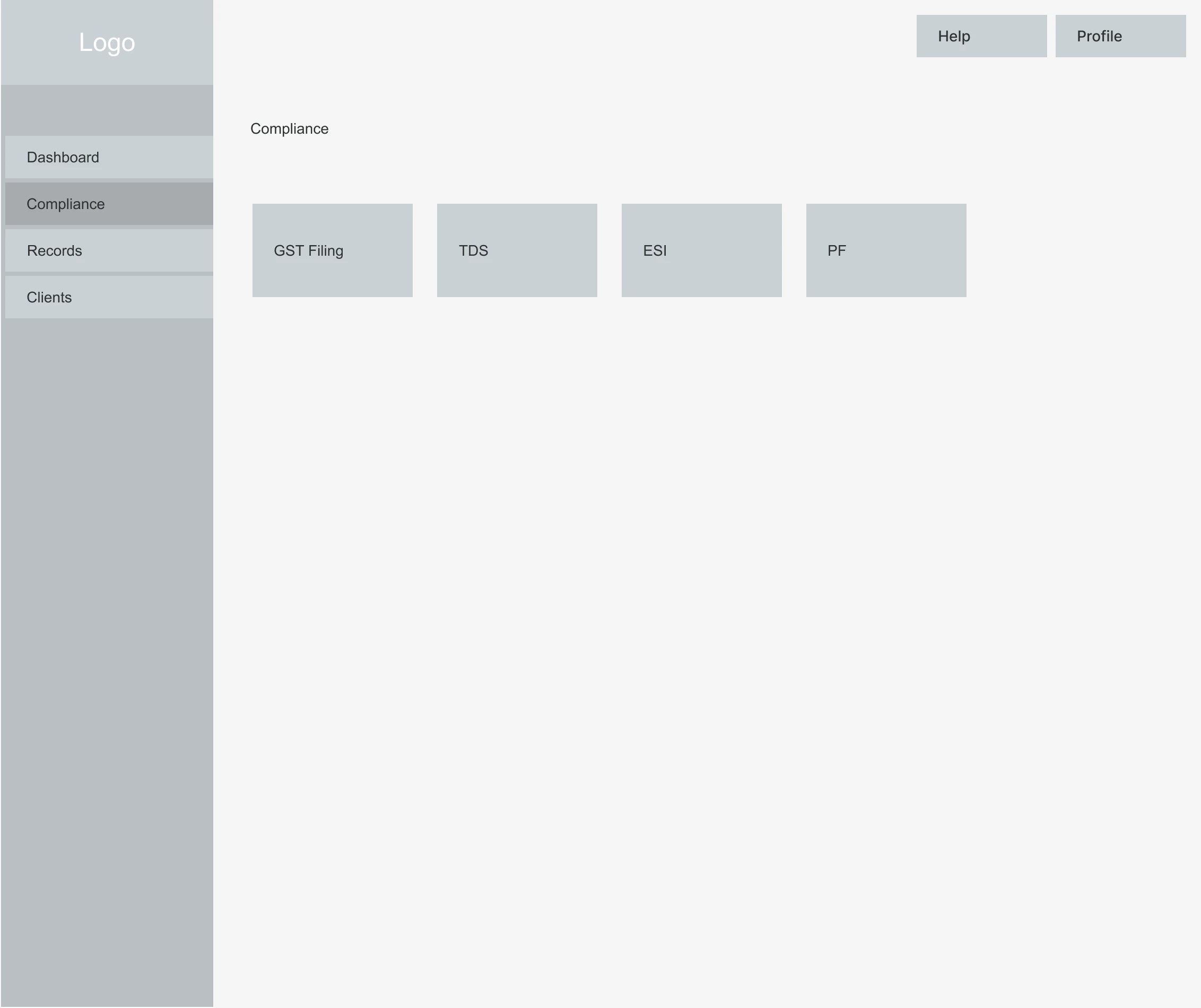

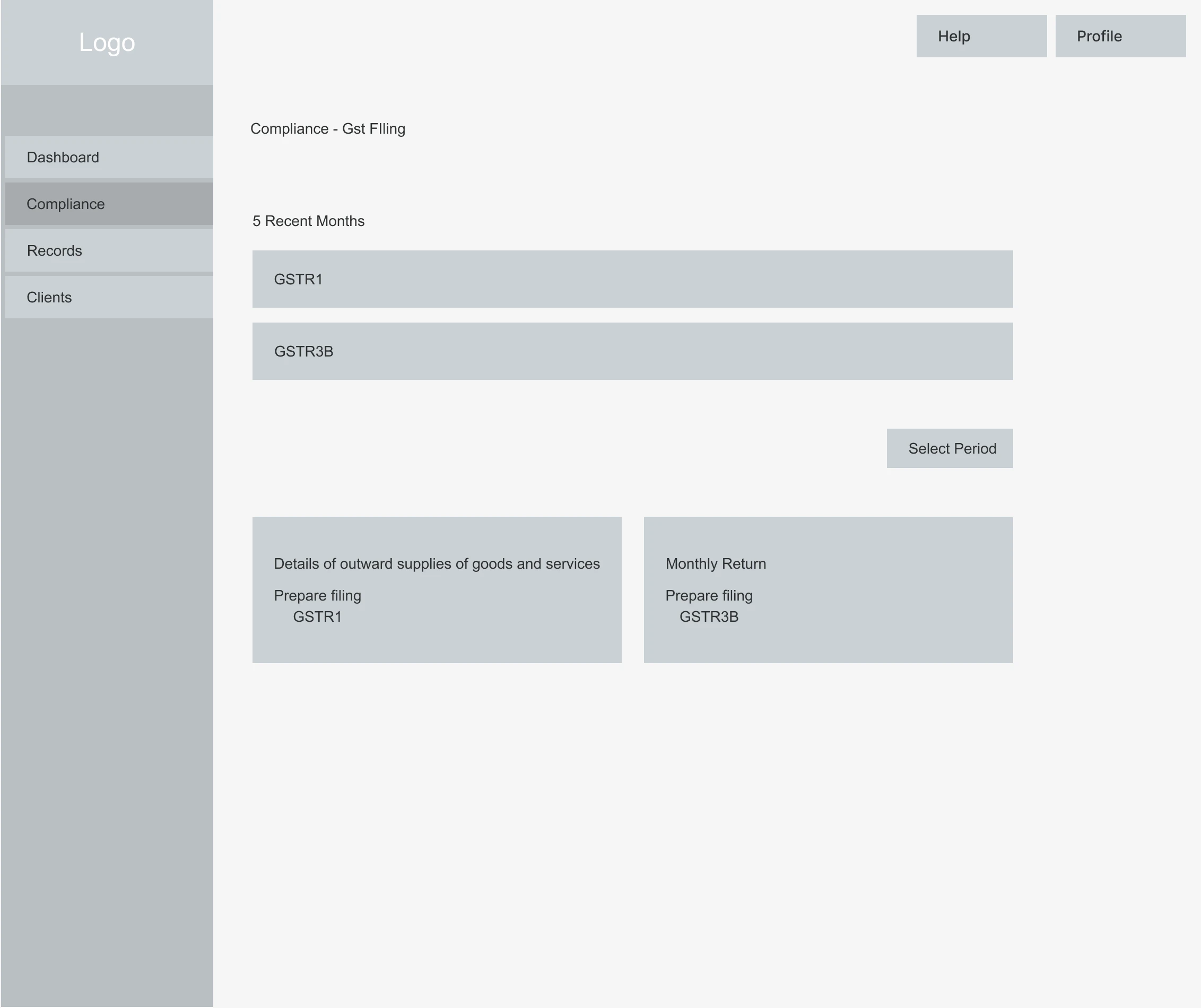

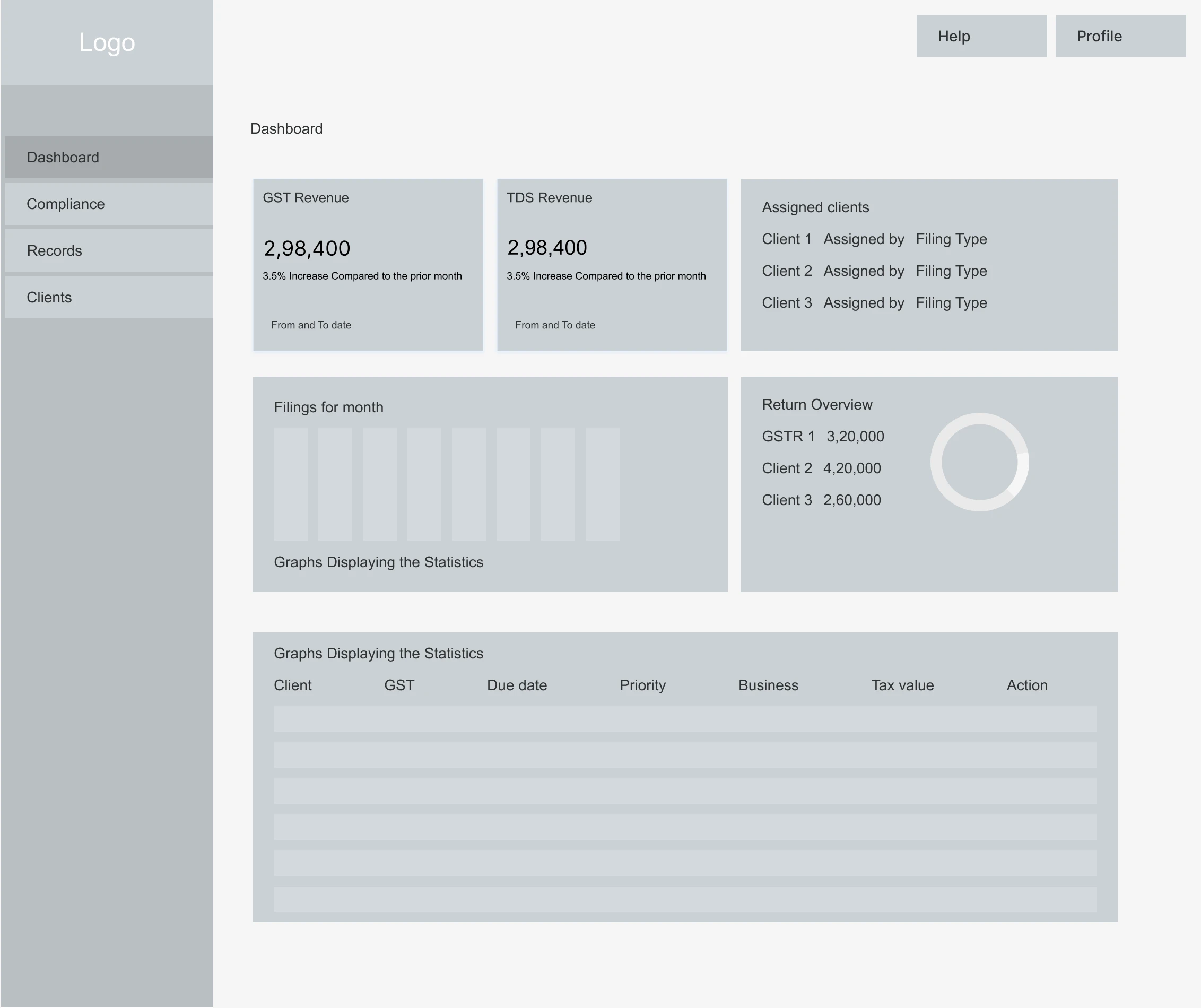

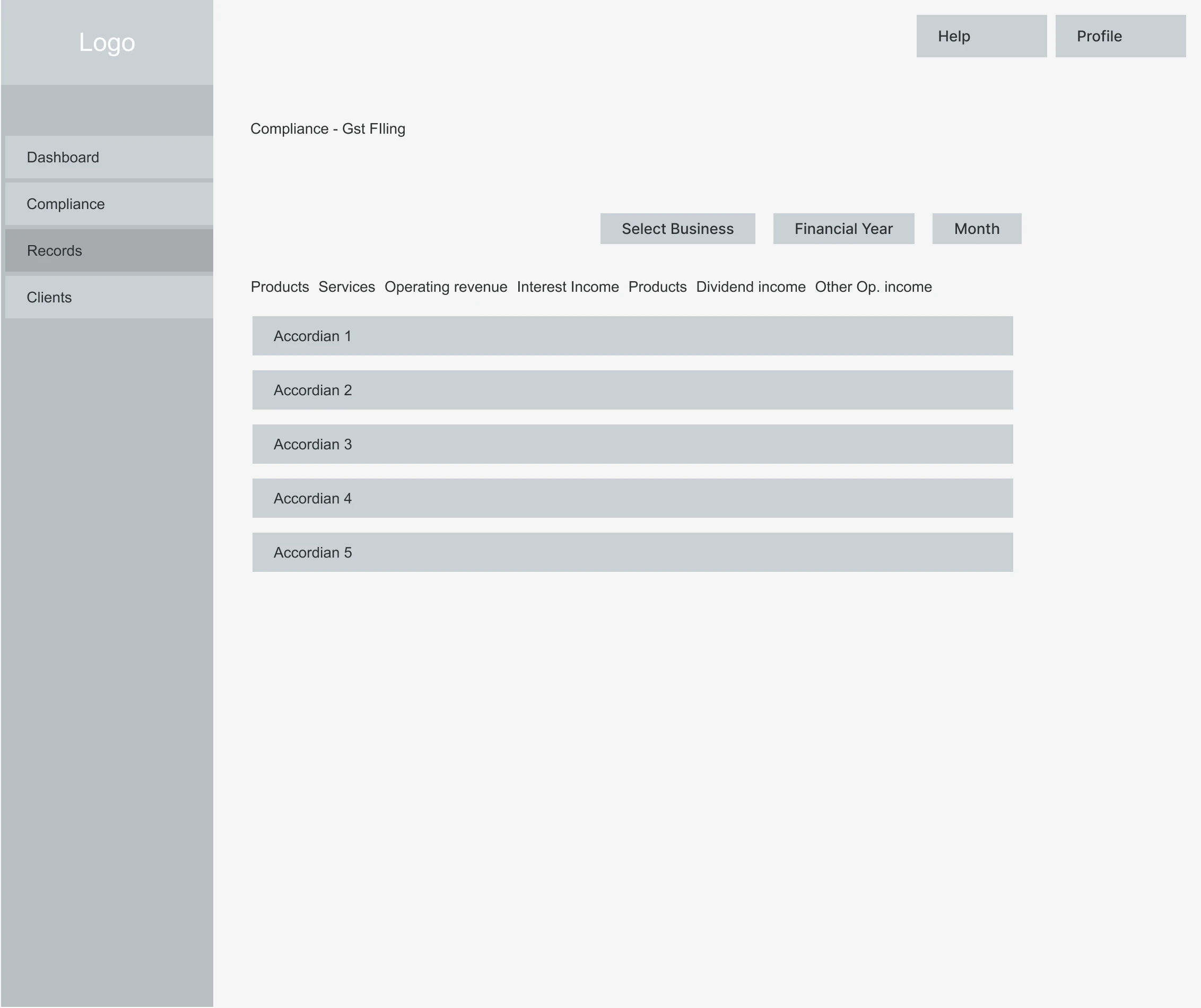

Wireframes: Defining the Visual Blueprint

I began with low-fidelity wireframes to outline the platform’s core structure, highlighting key UI elements and navigation flows. These early designs allowed rapid validation of layout decisions and user journeys, ensuring everything aligned with accountant workflows before moving to higher-fidelity designs.

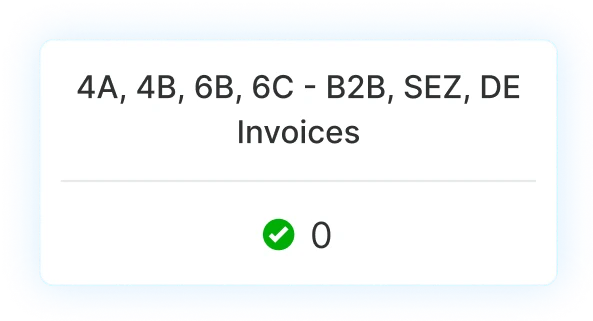

Records: Business details, invoice data, and other records in Accordion panels to toggle sections.

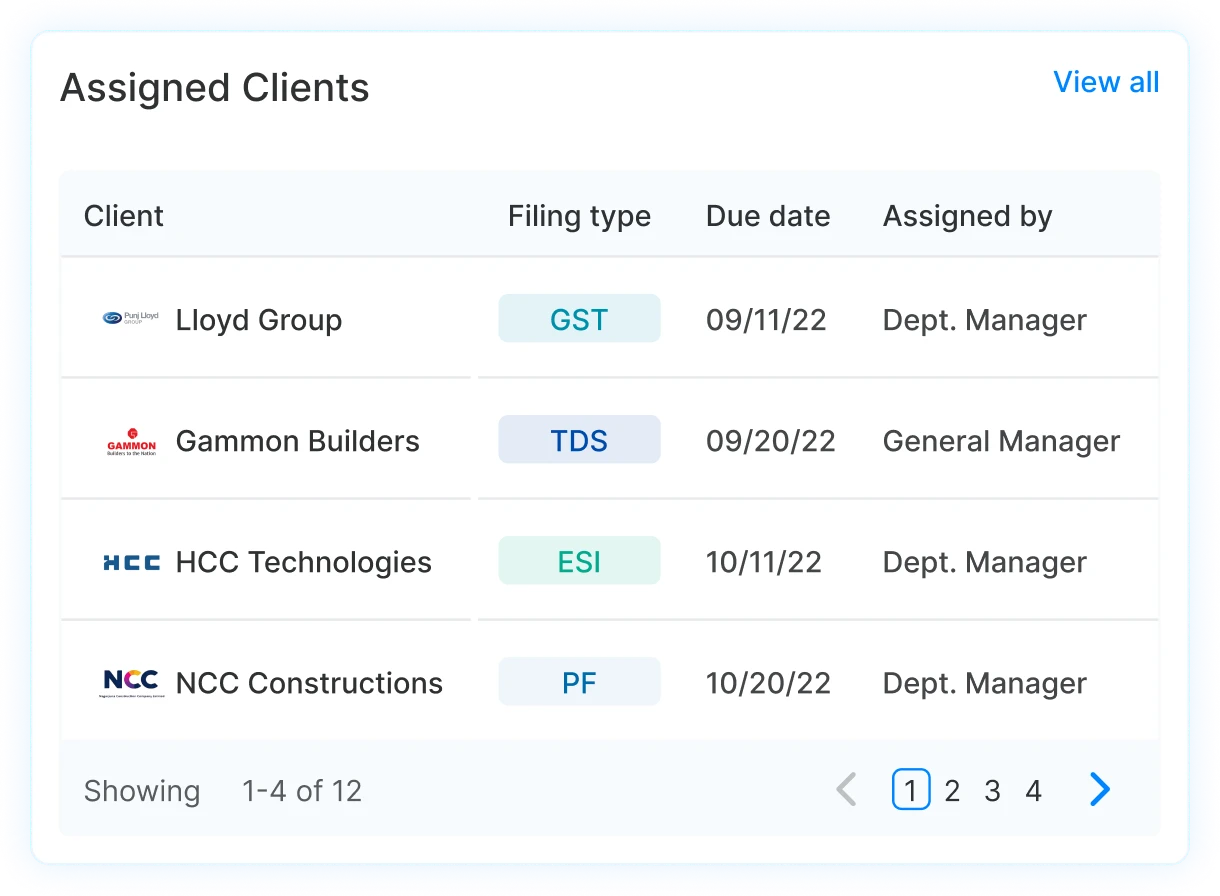

Dashboard page: Displays quick stats like active clients, pending filings, and due dates

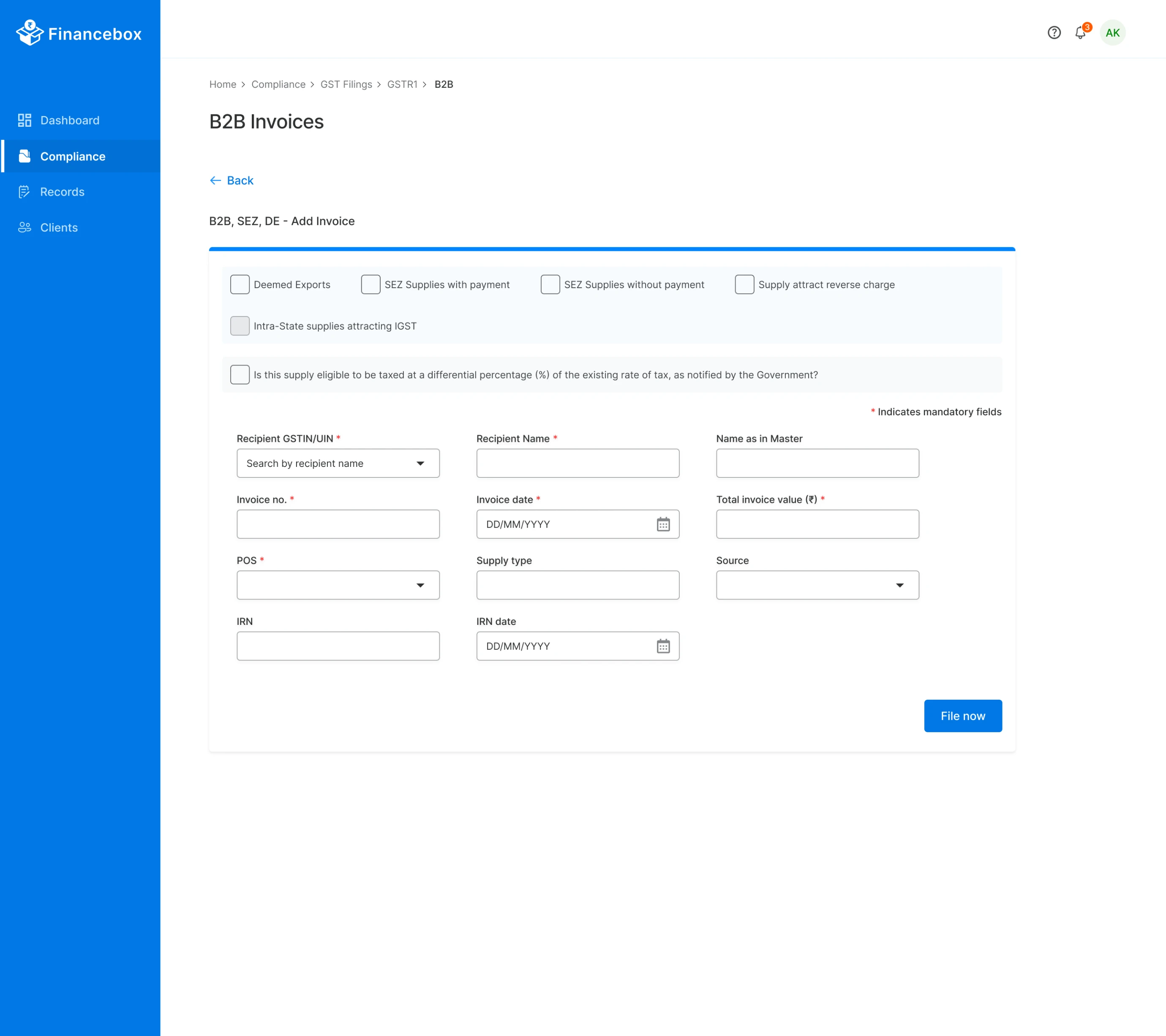

Allows users to differentiate B2B and B2C invoices through cards

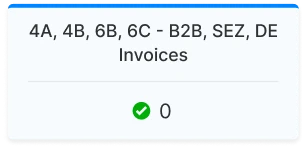

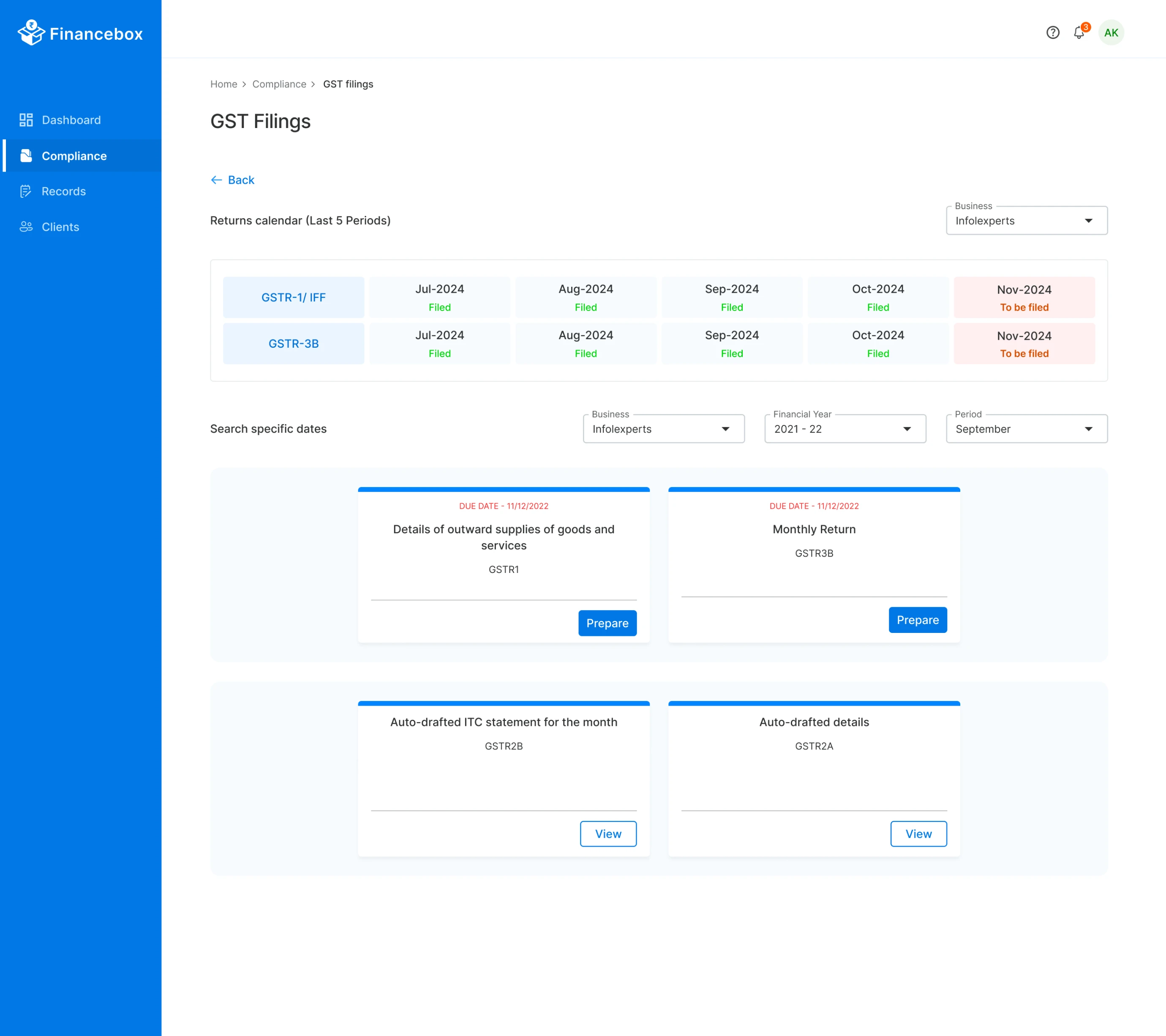

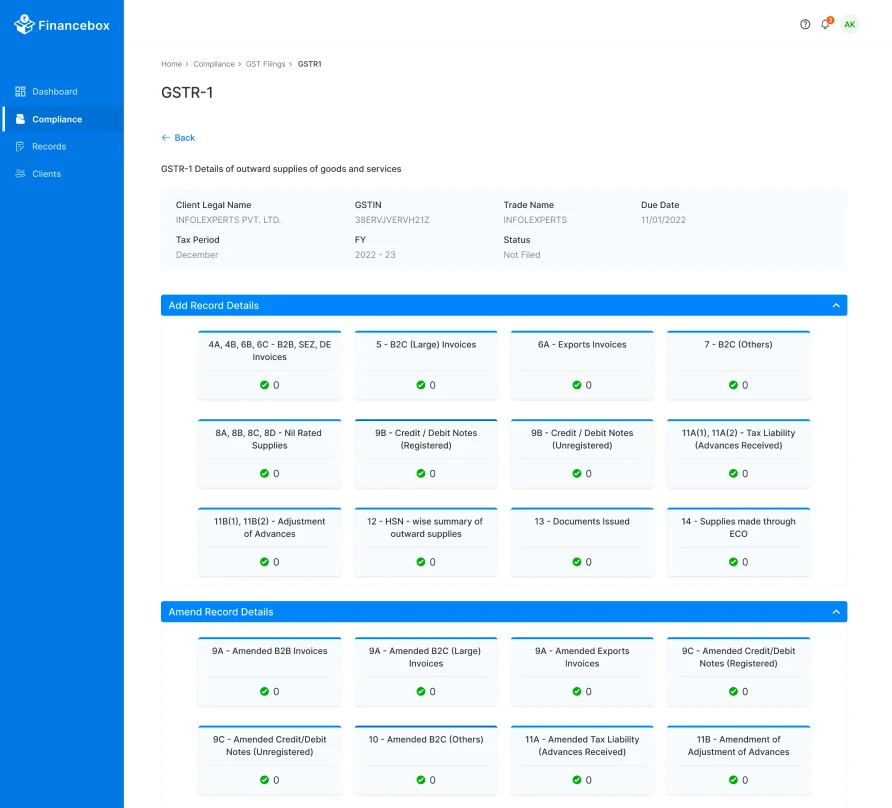

Compliance section: Centralized hub for GST, TDS, and other filings

Filing Section: Amend record details and proceed to file, streamlining the entire process

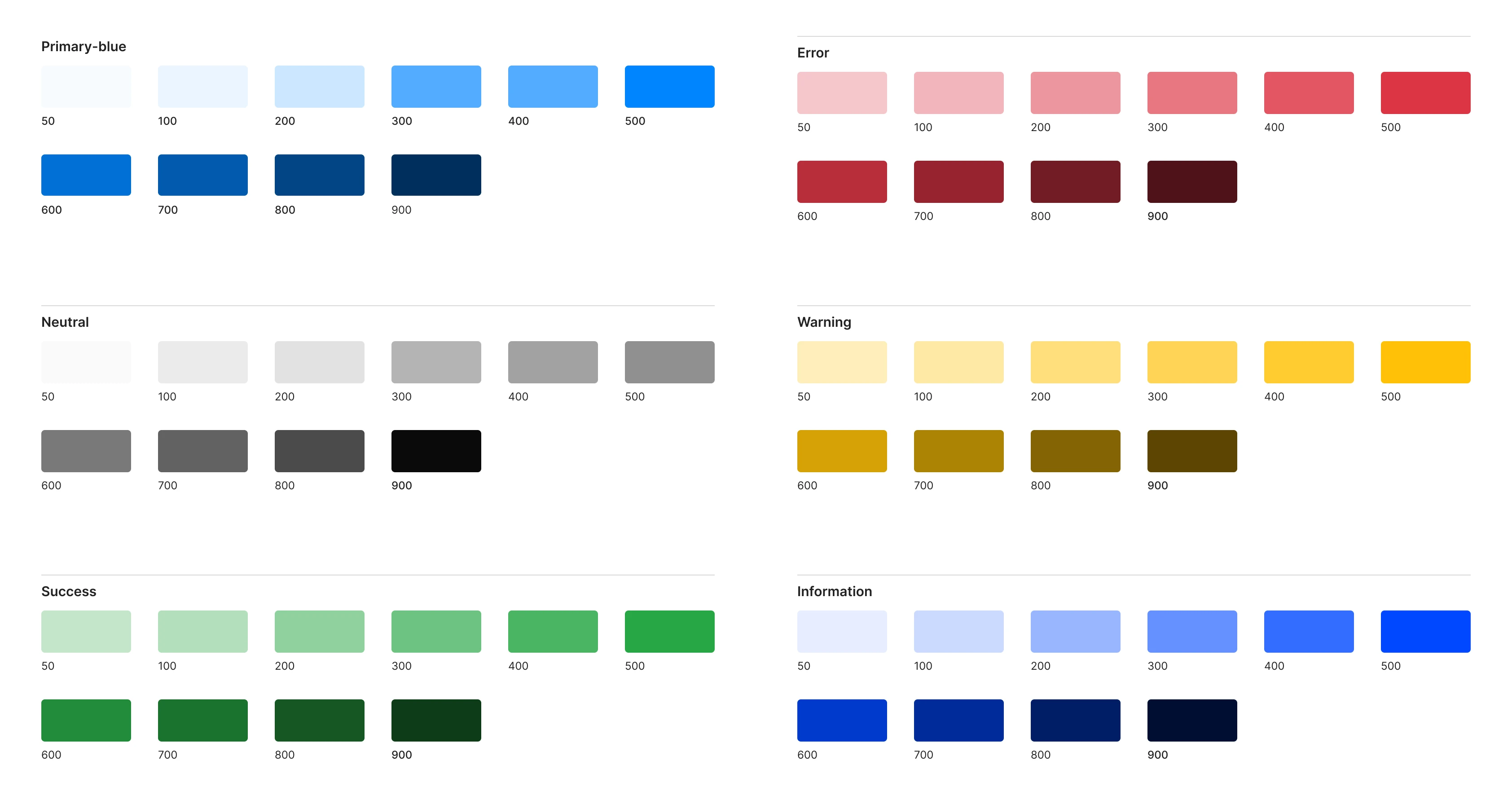

Strategy

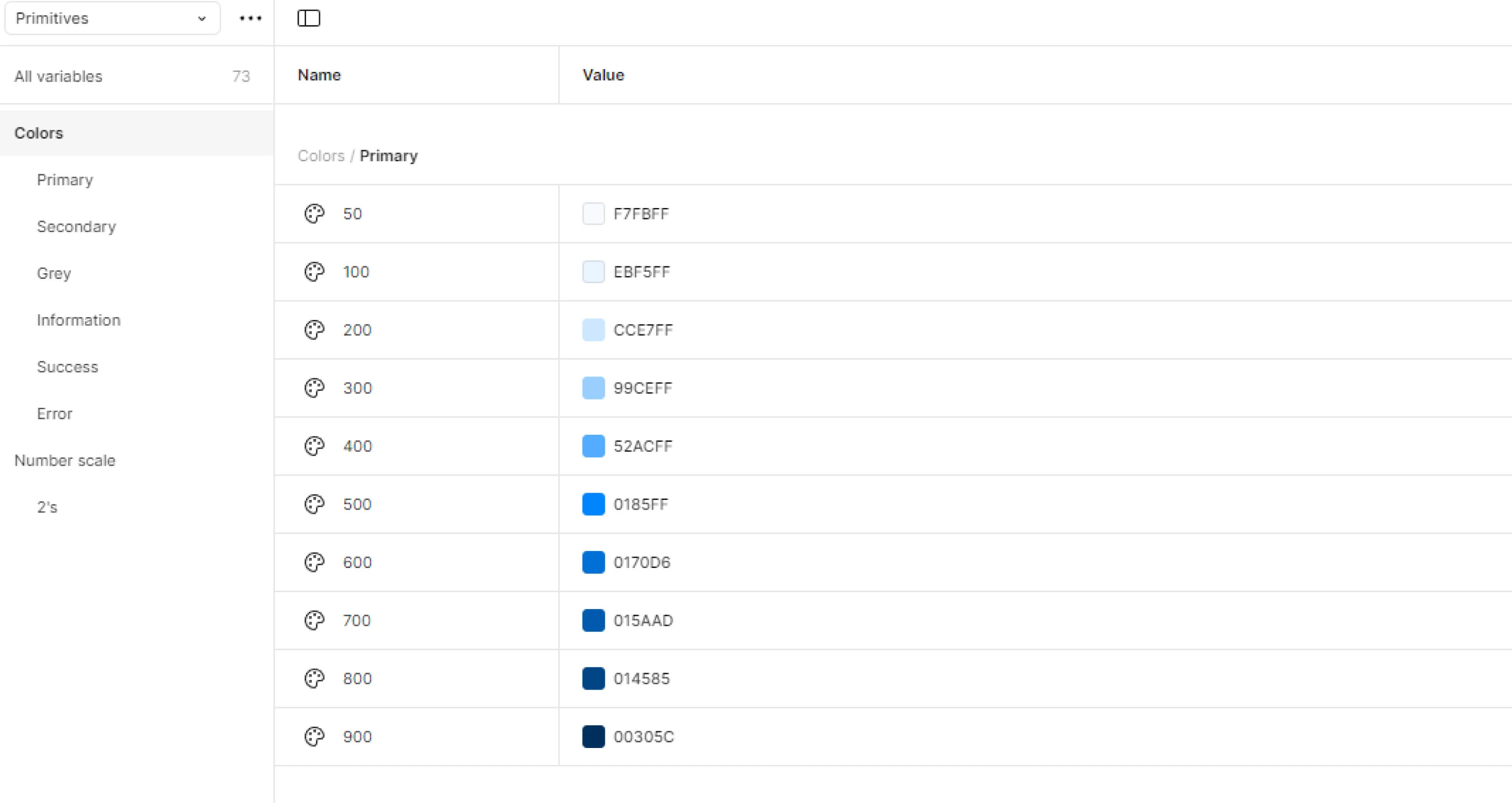

Design System: Defining Visual Consistency

To define the platform’s visual identity, covering colors, typography, spacing, and iconography for consistency. Building on this, a design system introduced reusable components like buttons, tables, forms, accordions, and alerts, ensuring scalability and efficiency in both design and development.

Brand Logo

Color Scheme

Financebox

Financebox

Typography

Variable Collection

Base Color

Semantic Naming

Hex 0185FF

Colors/primary/500

Strategy

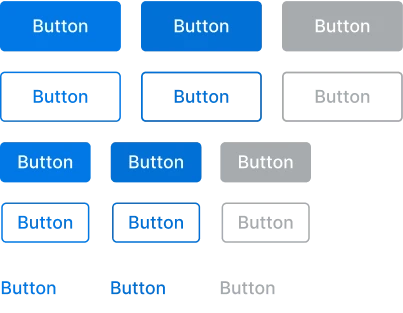

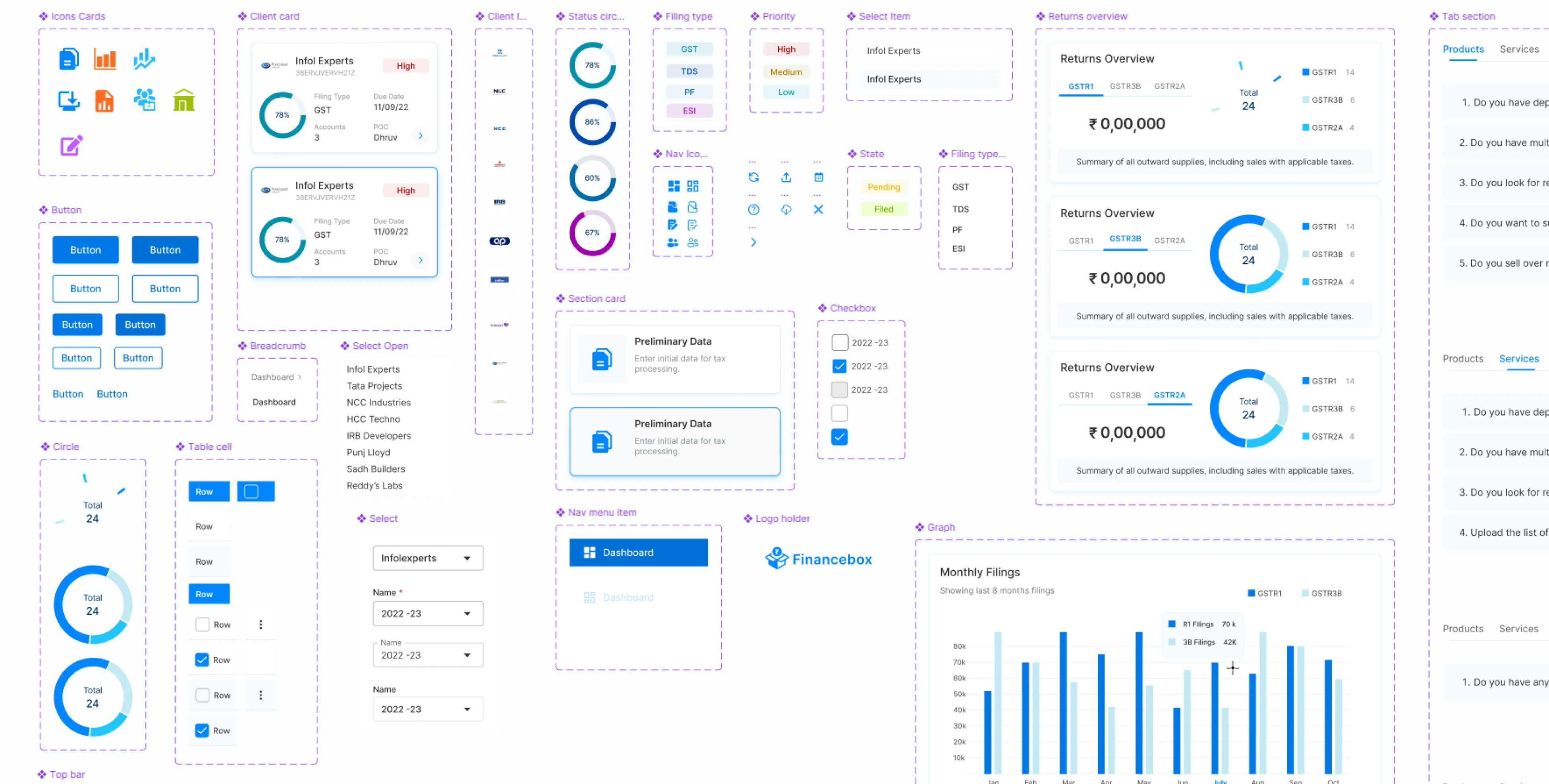

Component Library

The component library was designed as a collection of reusable UI elements like buttons, tables, forms, and accordions. It ensured consistency, scalability, and faster development, maintaining a unified design language.

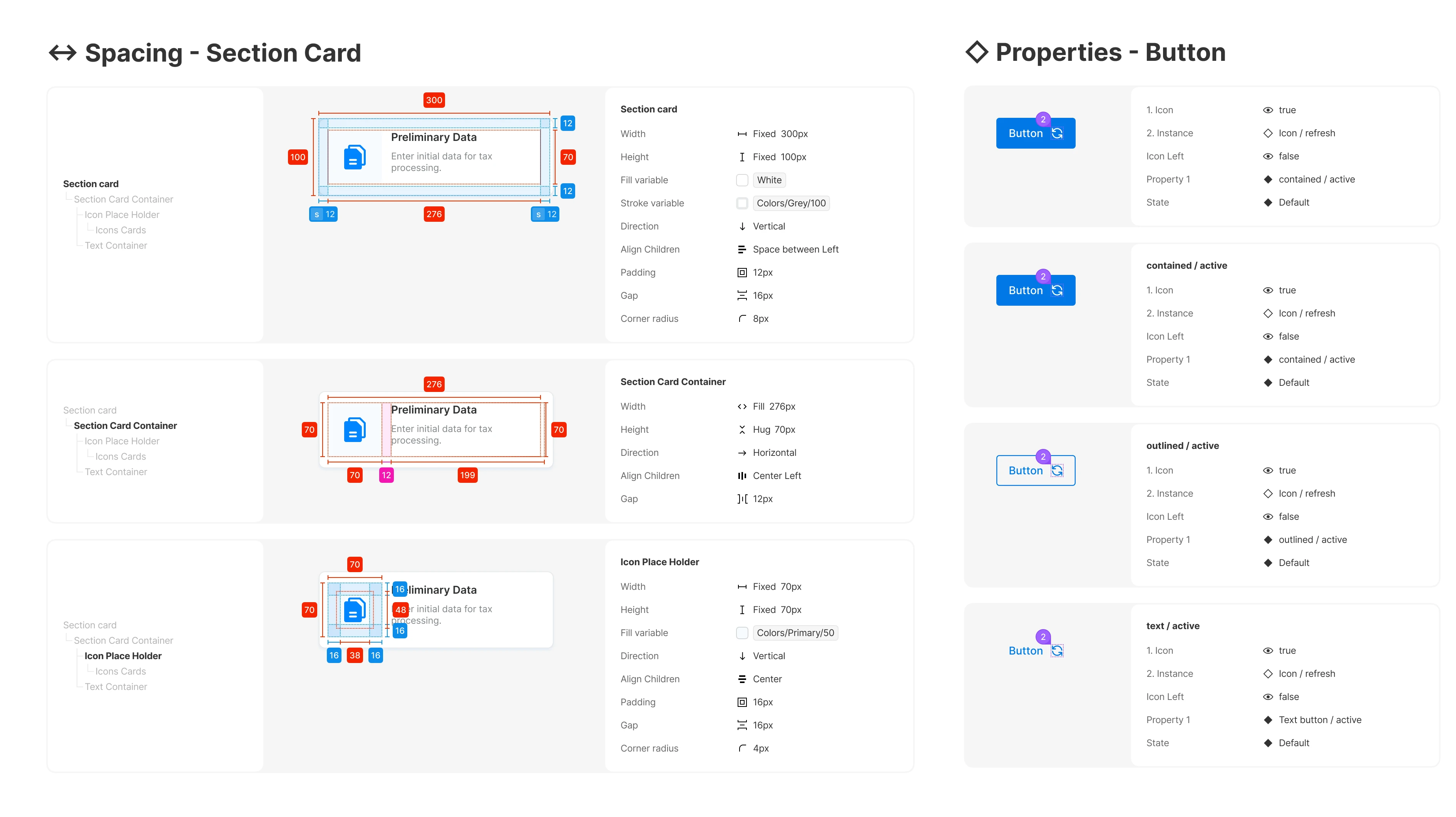

Strategy

Design Documentation

Detailed guidelines and usage rules for components, enabling smooth handoffs and ensuring design consistency during development and updates.

UI Screens

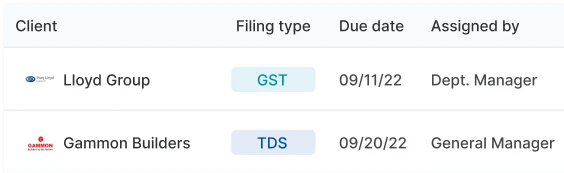

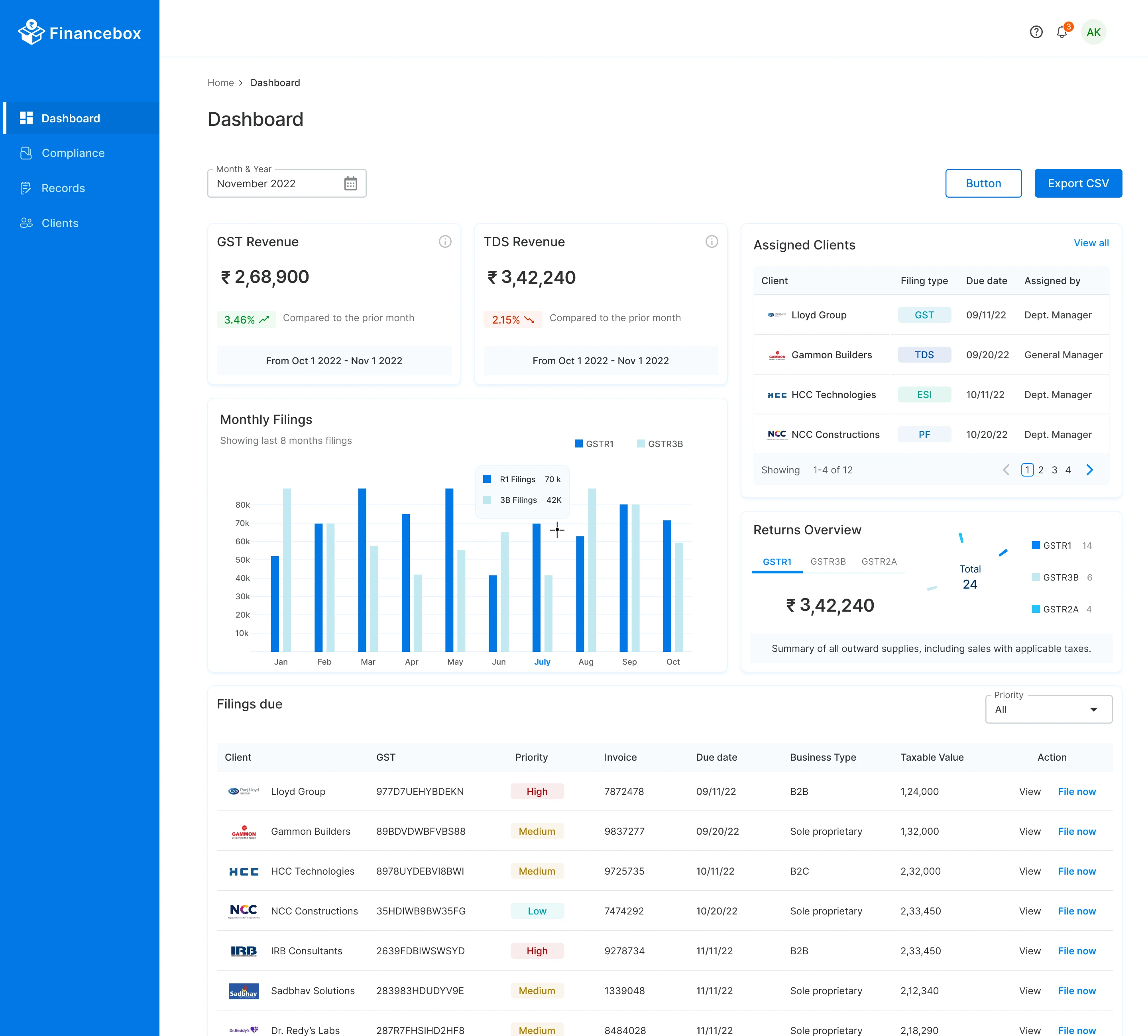

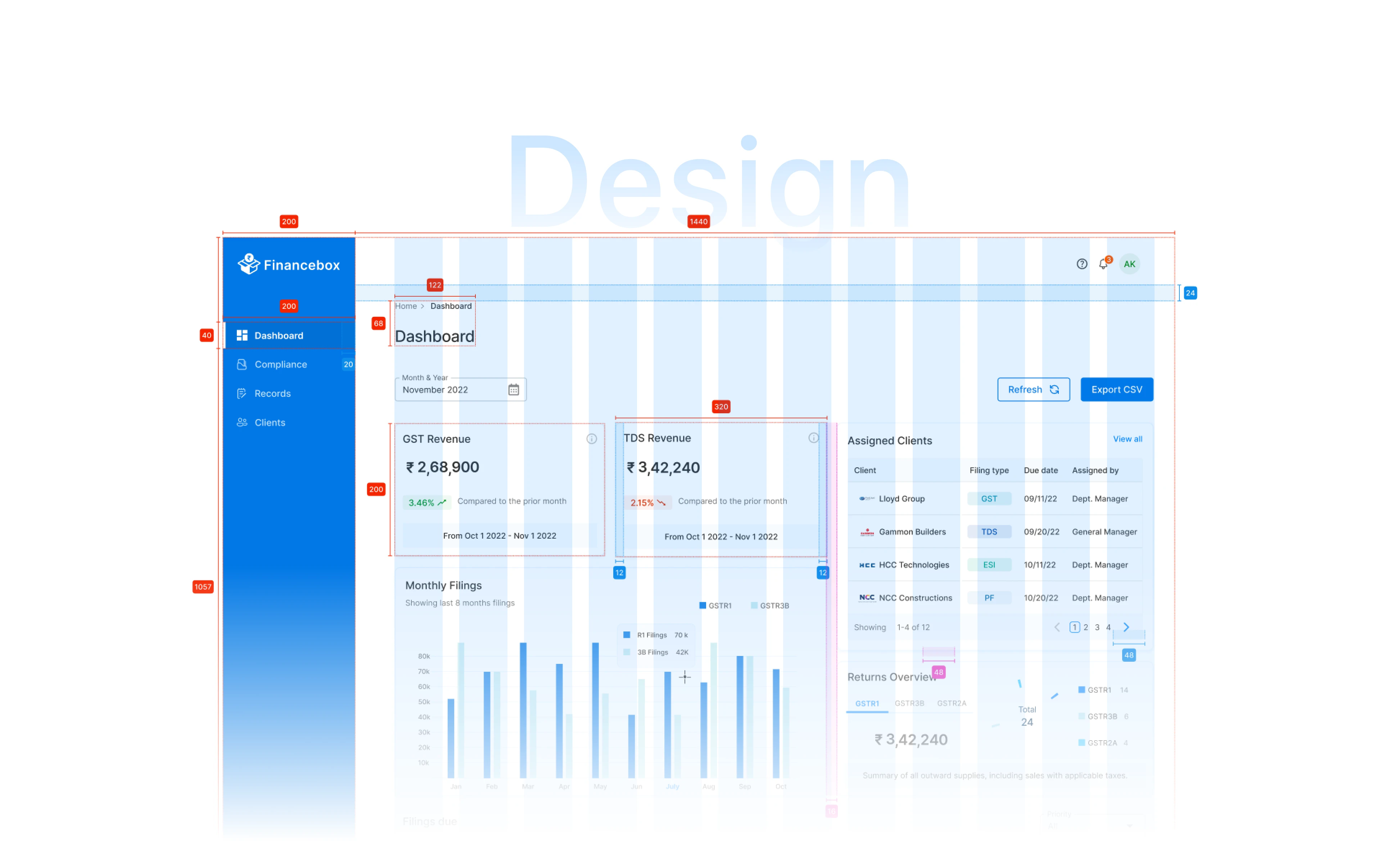

Dashboard

Provides accountants with a centralized view of filing statuses, quick stats, and upcoming deadlines. It offers actionable insights and shortcuts to streamline daily tasks and client management

Strategy

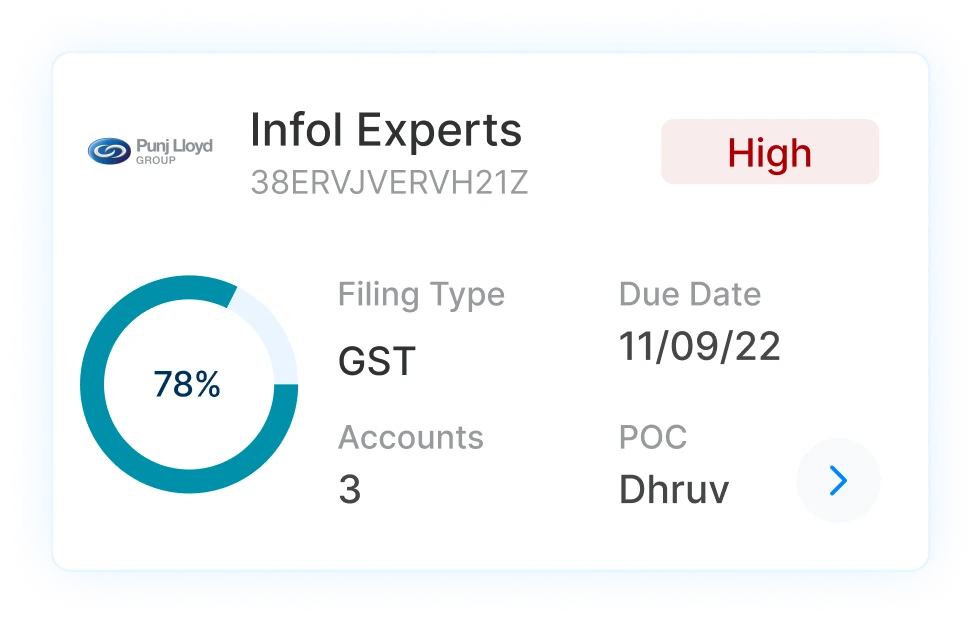

Compliance

This section serves as the core workspace for accountants to file GST returns, amend records, and manage invoices efficiently. It streamlines tax filing workflows, ensuring accuracy and timely submissions.

Strategy

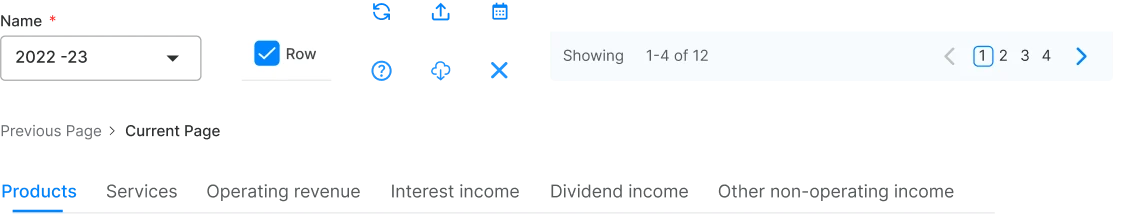

Records

Allows users to organize preliminary data, data sheets, and reports for each client. It helps streamline business details, including products, services, and tax-related information, ensuring seamless data management and compliance tracking.

Financebox

Next Steps

Future Roadmap

Feature Enhancements – Add progress indicators, preset filters, and automated report scheduling based on user feedback.

Scalability Improvements – Expand the platform to include ESI, PF, and other compliance modules.

Continuous Testing – Monitor user behavior and performance metrics to guide future iterations and updates.

Insights

Key Takeaways & Learnings

Simplified Tax Filing – Reduced filing time by 40% and improved task completion rates to 95%, streamlining complex workflows for accountants.

User-Centric Design – Focused on intuitive navigation, customizable dashboards, and multi-client management to enhance usability and efficiency.

Scalable Framework – Built a design system and component library to ensure consistency, scalability, and future expansions.

Impactful Results – Achieved a 90% user satisfaction rate and onboarded 200+ new clients post-launch